They will notify you once your identity is used or listed for sale, helping you take steps to protect yourself immediately. Enabling two-factor authentication significantly enhances the security of your online accounts. By requiring an additional verification step beyond a password, it greatly reduces the risk of unauthorized access and potential compromise of your personal information. Take the time to enable 2FA for your important accounts and enjoy the added peace of mind that comes with this robust security measure.

How SSNs End Up On The Dark Web?

We don’t recommend you try it due to the dangers and potential legal implications involved. To file an identity theft report with the FTC, visit IdentityTheft.gov. You can also use the same resource to get a customized fraud recovery plan. Consider an SSN monitoring tool like Aura to alert you if your personal information is being illegally used. Mark is a staff editor at Gen who specializes in cybersecurity and identity protection.

Can You Change Your SSN If It Was Leaked?

It is calculated using the information contained in your Equifax credit file. Lenders use many different credit scoring systems, and the score you receive with Aura is not the same score used by lenders to evaluate your credit. Since it’s almost impossible to remove data once it’s been leaked to the Dark Web, prevention is the best way to protect yourself.

How To Protect Your SSN From Future Exposure

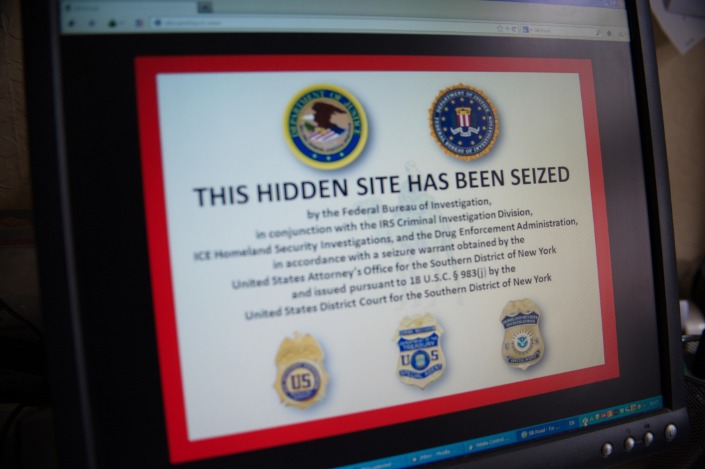

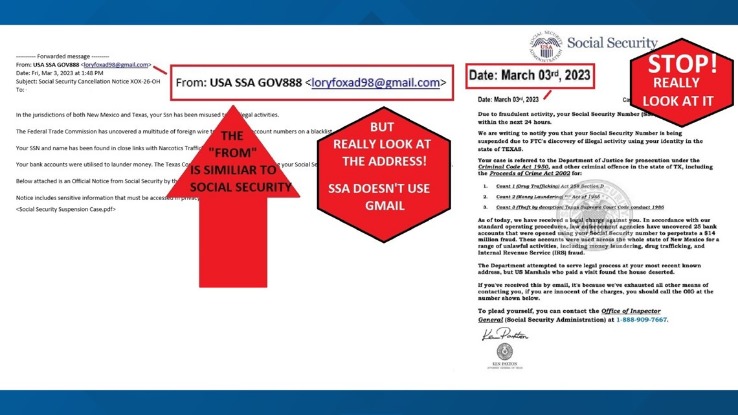

To scan for more sensitive information — such as your SSN, credit card details, or even passport numbers — you need to sign up for a full Dark Web monitoring service. While data breaches are the primary means by which your SSN can end up on the Dark Web, breaches aren’t the only threat. Scammers can use phishing websites, hack Wi-Fi networks, and use bots and malware to steal personal information.

Strengthen Your Online Security

You can freeze and unfreeze your credit report for free, but you’ll need to contact each credit bureau separately to implement the freeze. Social security information is often used for financial fraud, particularly related to insurance and credit cards. Suspicious banking activity is one of the first signs that something might be up. Cybercriminals can use your personal information to take out loans in your name, claim your tax returns, or open new credit cards. Since they obfuscate their activities using your name, this digital footprint would be tracked to you.

- Otherwise, you may be held liable for all criminal activity that took place with your Social Security number in use.

- Additional detailed information is available and the video recording of a recent town hall.

- This added layer of complexity makes it attractive to cybercriminals who want to operate under the radar.

- An IP PIN, or Identity Protection Personal Identification Number, is a six-digit number the IRS assigns to help them verify your identity when you file a tax return.

They can assist you in protecting your accounts, monitoring for suspicious activities, and providing guidance on the next steps to take. Stay vigilant and continue to monitor your financial statements and credit reports regularly for any signs of unauthorized activity. If your SSN was leaked, check your credit reports (Experian, Equifax, and TransUnion) for any unauthorized activity (and do so regularly going forward!). Report any suspicious transactions to the credit bureaus, via their websites, and place a credit freeze to prevent new accounts from being opened in your name.

Strengthen Your Online Accounts

Aura’s service does not monitor for all content or your child’s behavior in real time. If you don’t feel safer after signing up for Aura, we offer a 60-day money-back guarantee on all annual plans — no questions asked. If the worst should happen, all Aura plans include round-the-clock U.S-based support and up to $1 million in identity theft insurance to cover eligible losses and expenses.

He aims to help readers learn how to navigate their digital lives more safely. As identity thieves become more advanced, you need to combine personal information protection, document handling, and cybersecurity best practices to protect your SSN. Data breaches and phishing attacks are two of the most likely ways for criminals to get hold of your Social Security number to sell or list on the dark web. However, your SSN can also be compromised by malware lurking on your computer, fake forms on unsafe websites, through mail theft, or if you lose your wallet and it falls into the wrong hands.

File A Fraud Report With The FTC

To keep your information safe, you should use a password manager that can update your passwords with strong, unique ones and scan the dark web. Once your SSN has been found on the dark web, you should report it as stolen to the Federal Trade Commission (FTC). Notifying the FTC will result in receiving personalized steps based on your situation. The FTC will use all the information you provide by sharing it with law enforcement to investigate the identity theft. This is why it’s important to report your SSN as stolen right away, so the FTC can collaborate with law enforcement to help you achieve justice.

- A cybercriminal group called “USDoD” exposed a database owned by National Public Data, a background check company, on a dark web forum.

- By implementing these preventive measures, you can significantly reduce the risk of your SSN and other personal information being compromised.

- A credit freeze prevents anyone from accessing your credit file — which means that scammers won’t be able to ruin your credit score.

- Scammers do everything they can to access your accounts — and your Social Security number is one of their favorite targets.

- If you find you’re included in the breach, the steps you should take are not necessarily new.

Your stolen SSN can also be used to file fraudulent tax returns, and even obtain medical care. In addition, your SSN may be sold multiple times on the dark web, which can make it difficult to regain control of your personal information. A credit freeze prevents new creditors from accessing your credit report, which makes it more difficult for them to open new accounts in your name. However, extended fraud alerts are only available to victims who have filed a police report or identity theft affidavit. If you’ve been a victim of identity theft, you can also place an extended fraud alert on your credit file, which lasts for seven years. To place a fraud alert, you’ll need to contact one of the nationwide credit reporting companies and provide proof of your identity, such as a copy of your driver’s license or passport.

Passwords are among the most commonly leaked pieces of sensitive personal information. You can use Aura’s free Dark Web scanner to see which accounts are at risk. Then, for added security, enable 2FA on every account that allows it — especially your online bank, email, and social media accounts. Criminals often use stolen SSNs to file fraudulent tax returns and claim refunds.

Set Transaction Limits On Your Bank Accounts And Credit Cards

Additional detailed information is available and the video recording of a recent town hall. In the meantime, campus IT officials encourage everyone to report any suspicious email or telephone calls by contacting IT staff at email protected . Services like Experian or Norton monitor the dark web for your SSN and other personal data, alerting you if your information is found. While you’re at it, we recommend you use a reliable password manager like NordPass to securely store all your new passwords. If you sign up for the Social Security Administration’s myE-Verify website, you can track all the jobs you’ve had in the past (where you used your SSN). To safeguard your Social Security number, use the government’s free Self Lock feature.

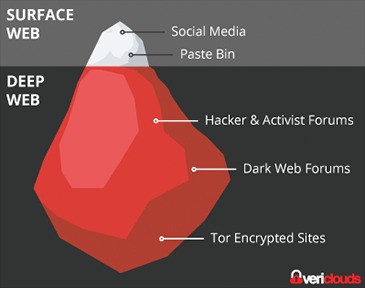

You can request an IP PIN by creating an IRS account, verifying your identity, and following the on-screen instructions. After completing the verification and confirming that the IRS’ information is accurate, click Enroll in IP PIN. The dark web is a hidden, unregulated part of the internet, which makes it a hotbed for hackers selling stolen personal information, including Social Security numbers (SSNs).

Efforts are being made to combat illegal activities on the dark web, but it remains an ongoing battle. Unlike the surface web, where websites are easily discoverable, the dark web operates as an encrypted network, masking the true identity and location of its users. This anonymity has attracted various individuals and groups, including cybercriminals and those seeking to engage in illicit activities. The dark web is a covert part of the internet that is not indexed by search engines. It is a subset of the deep web, which represents websites and content that cannot be accessed through conventional search engines.

Some examples of MFA include a PIN, a code from an authenticator app, a fingerprint scan or even your specific geographic location. Without having access to your MFA, a cybercriminal will not be able to log in to your accounts if you have enabled it as an extra form of security. The Internal Revenue Service is committed to working with taxpayers to ensure that all federal tax accounts remain secure. You should contact your state taxing authority if you suspect your state tax account was compromised. If you recently found out that your child’s personal information was compromised, it’s important you know what to do to minimize the impact and make sure it doesn’t happen again. Experian spoke with Eva Velasquez, president and CEO of the Identity Theft Resource Center, about the impacts of identity fraud and the possible actions you can take if your child has been affected.