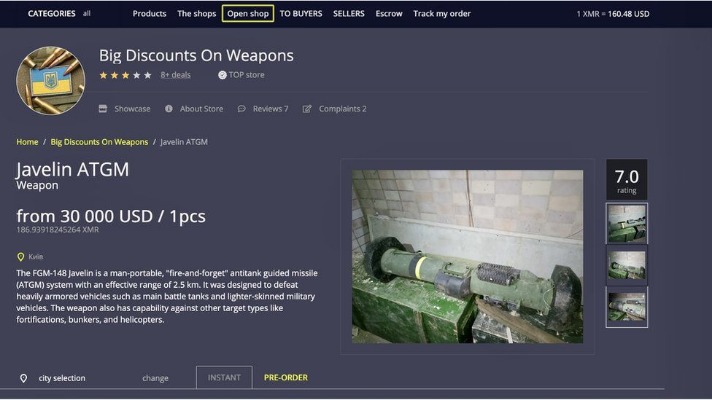

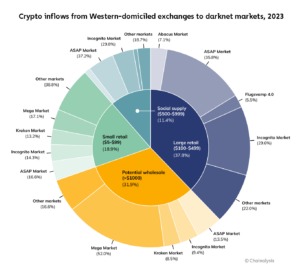

Search filters let you sort by category, price, seller rating, or shipping source, while live deal tracking and detailed seller profiles—averaging 4.8/5 from 50,000+ reviews—keep things open. Abacus sets a high bar for sellers, demanding a 90% trust score to stay active, which holds scams under 2%, a rare feat in this game. With dual-currency support, strong uptime, and a broad catalog, it’s a model for what a leading darknet market can be in 2025, winning nods from users for its dependability and range. Despite most darknet markets banning the sale of fentanyl in their terms of service, nearly all mainstream Western-facing markets have vendors that sell fentanyl-laced products. While it received a relatively small share of large retail purchases as shown in the previous chart, Abacus Market is one such example.

Why Is It Critical To Monitor Dark Web Marketplaces?

Cryptojacking exploits victims’ devices for unauthorized cryptocurrency mining, leading to performance issues and financial losses. Fake wallets mimic legitimate apps, tricking users into depositing funds or revealing private keys. Fraudulent exchanges lure investors with promises of high returns or low fees before stealing their money. The cryptocurrency space remains vulnerable to scams that exploit investor trust and security weaknesses. Fraudulent ICOs, rug pulls, and phishing attacks deceive users through false promotions and impersonation tactics.

This suggests that the multiseller activity is sensitive to external shocks but also that it yields higher profits. With the advent of several markets at the beginning of 2014, the number of multisellers rapidly grows, representing more than 20% of all sellers until the beginning of 2016 (see Supplementary Information Section S3). During 2016 and 2017, AphaBay becomes the dominant market (see Fig. 3), polarizing sellers around its own ecosystem, such that the fraction of multisellers decreases to 10% of all sellers until its closure.

Cryptocurrency Trading

The largest component of the S2S network of U2U transactions between sellers for each year with the respective number of nodes (N). The nodes are sellers that are active in that year, and an edge is placed between two sellers if at least one transaction occurs between them during that year. The network is mostly populated by U2U-only sellers, followed by market-only sellers. After a major external shock in 2017, the S2S network shrinks but, unlike the multiseller network, recovers, and grows again (though slower than the multibuyer network). Throughout the whole period of observation, the dominant category of buyers is market-U2U buyers followed by market-only buyers, representing on average 52% and 42% of all buyers, respectively. The U2U-only category is comparatively small, representing only 6% of all buyers on average.

Alphabay Scales Up

Negative and positive numbers indicate the days prior and after the closure, respectively. Only the 33 DWMs that closed during our time period are considered in the analysis. Telegram explained that the accounts were linked to fraud and money laundering, activities that violate the app’s terms.

Vice City Tightens Vendor Policies

These platforms allow vendors to reach customers who are less technologically savvy, whilst also mitigating against market turbulence caused by darknet market exit scams or law enforcement takedowns. This migration is further bolstered by the fact that the majority of new Western DNMs launched in 2024 have been characterized by poor design features or security issues. However, trading behaviour in DWM closely resembles what is observed on regulated online platforms despite their significant differences in operational and legal nature14. Nevertheless, due to their unregulated nature, DWMs exhibit behaviours not observed in regulated marketplaces. They offer anonymity to their users by using and developing specialized tools.

- Its 93% escrow success rate resolves disputes in 48 hours for 80% of cases, solid but lagging behind top-tier security.

- Together, they process over $31 million in monthly trades—more than 60% of our top 10’s total—reflecting their outsized impact.

- For example, in Russia-based DNMs, the illicit drug trade remains predominant.

- OpenBazaar, for instance, only has between 10 and 20 vendors with substantial traction, while the most popular markets have hundreds.

- Below, we compare our top 10 across these dimensions, drawing from platform data, user feedback, and darknet analytics to highlight what sets each apart in the deep web markets of 2025.

Largest Dark Web Marketplaces By Share

This market is not open to the general public and is subject to a thorough vetting process to ensure its security. In fact, WeTheNorth is more of a private club than an open market – something its operators want. Every potential participant’s credentials must be vigorously vetted before they can join. That way, they aim to create secure forums and limit outsiders like law enforcement. Likewise, law enforcement agencies each day continue to fine-tune their strategies to get past these networks.

Silk Road Drug Lord Forfeits $150m In DEA’s Largest Ever Crypto Seizure

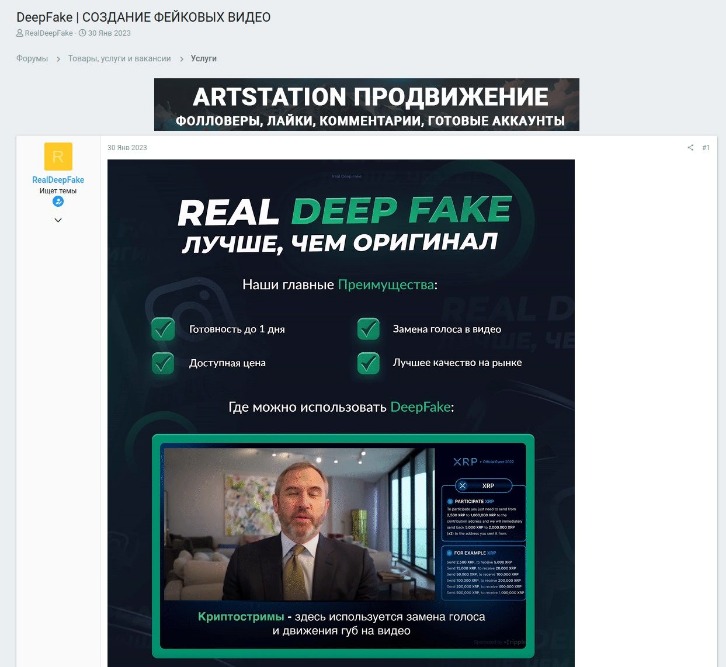

Stay ahead of the curve with the latest updates from the darknet market ecosystem as of February 27, 2025. This section compiles critical developments from our top 10 darknet rankings, offering a real-time pulse on the shifts shaping onion marketplaces, crypto trading platforms, and dark pool trading hubs. Each update reflects how these markets adapt to user demands, technological advancements, and external pressures, ensuring their relevance in the deep web markets of 2025. The use of cryptocurrency in vendor shop drug sales saw a significant surge over the past year. TRM Labs is the only blockchain intelligence provider with a specialist category unique to individual drug vendors — and this year, we saw incoming volumes sent to illicit vendor shops more than double. Vendors today are choosing to establish vendor shops and engage in direct deals through a diverse array of encrypted communication applications and email.

Looking closer at ASAP Market inflows, it won some share of revenue across all drug purchase types, receiving 37.1% of social supply, 35.7% of large retail, 16.5% of small retail, and 13.5% of wholesale purchases. On a smaller scale, Mega Darknet Market placed a few ads with QR codes in public places like Moscow subway trains. While tactics like these may have helped boost revenue for both markets, again, they have yet to match Hydra’s sizable financial success. The chart above shows that, while values haven’t risen back to 2021 levels, darknet market revenue has slightly rebounded since Hydra’s closure in 2022.

Cryptocurrency And Illicit Finance

- Businesses may use these services to sabotage their competitors, while individuals may seek revenge or simply want access to private information about someone.

- TorZon Market, a darknet marketplace, has managed to take a strong position in the shadow segment of the Internet in a short period of time.

- The nature of the dark web (anonymity and privacy) opens opportunities for drug dealers to reach a wide customer base across the globe without getting caught.

- Previous studies have shown that, although the number of users and transactions is larger in markets, the trading volume in the U2U network is larger than that of markets13.

But with blockchain intelligence advancing and global partnerships strengthening, law enforcement is better positioned than ever to detect, disrupt, and dismantle these operations. That extortion threat, combined with increased tracing and investigative pressure, led many users to flee the platform, dramatically reducing deposits and facilitating law enforcement’s final takedown. Department of Justice announced the results of Operation RapTor—an unprecedented international crackdown on darknet narcotics trafficking. Elysium Market, one of the most discussed platforms on the darknet, is a reincarnation of the previously closed Daeva Market and Revolution Market. These marketplaces, despite their potential, failed to attract proper attention and succumbed to strict control measures.

Unrivaled in its size, reach, and complexity, and vertically integrated network—along with its status as a crucial hub for illegal cryptocurrency cashout services—made it a significant player amongst darknet marketplaces. Its closure on April 5, 2022 created a seismic shift in the Russian-language darknet marketplace landscape. Darknet markets continue to show signs of recovery as their crypto revenue saw a rise in 2023 despite the sizable Hydra marketplace close in 2022. According to data published by blockchain forensics firm Chainalysis, fraud shops and darknet marketplaces saw their revenue increase to nearly $2 billion in 2023, up nearly 25% from figures for 2022. Alphabay reigns supreme with 60,000+ listings and $20M monthly trades, dominating 20% of darknet commerce via BTC and XMR. Its 25,000+ users and 3,000+ vendors trust its unmatched escrow and scale.

Starting in May 2022, it’s grown into a strong player with 25,000+ listings and $4 million monthly trades across BTC, XMR, LTC, and USDT, nabbing a 7% share of the darknet scene. With 14,000+ active users and 1,000+ sellers, ASAP mixes it up—drugs (60%), digital goods (20%), fraud tools (15%), and fake items (5%)—drawing traders who like payment options and quick moves in their crypto trading hub. Incognito Market sits at #4 in our 2025 darknet rankings, carving a niche as a privacy-focused trading spot in the anonymous world. Starting in June 2022, it’s grown steadily to 20,000+ listings and $2.8 million in monthly trades through BTC and XMR, holding a 5% share of the darknet scene.

Investigators noted that the operators likely shut everything down and left with user funds. In another significant operation, the FBI and Department of Justice dismantled the Qakbot malware network, active since 2008. Abacus had recently grown in dominance after Europol’s June takedown of Archetyp Market, handling $6.3 million in monthly sales and controlling over 70% of Bitcoin-enabled Western darknet trade. We have given each crypto dark web a ranking based on our comprehensive review of the features above. Had already amassed $12.15 million in sales by the end of its first month in operation (April 2022). As of this publishing, Mega currently appears to be the biggest of the five Russian language DNMs.

This cuts shipping times to 3–5 days vs. 5–7, enhancing user satisfaction by 20%. Markets like ASAP lead with BTC, XMR, LTC, and USDT, reducing fees by 20% and boosting its 7% share. In 2025, 60% of top 10 markets support multiple cryptos—XMR at 40% average, USDT at 15% in ASAP—reflecting a shift from BTC’s 80% dominance in 2023, driven by cost and privacy demands.